Bank Islam Hire Purchase Rate

Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period.

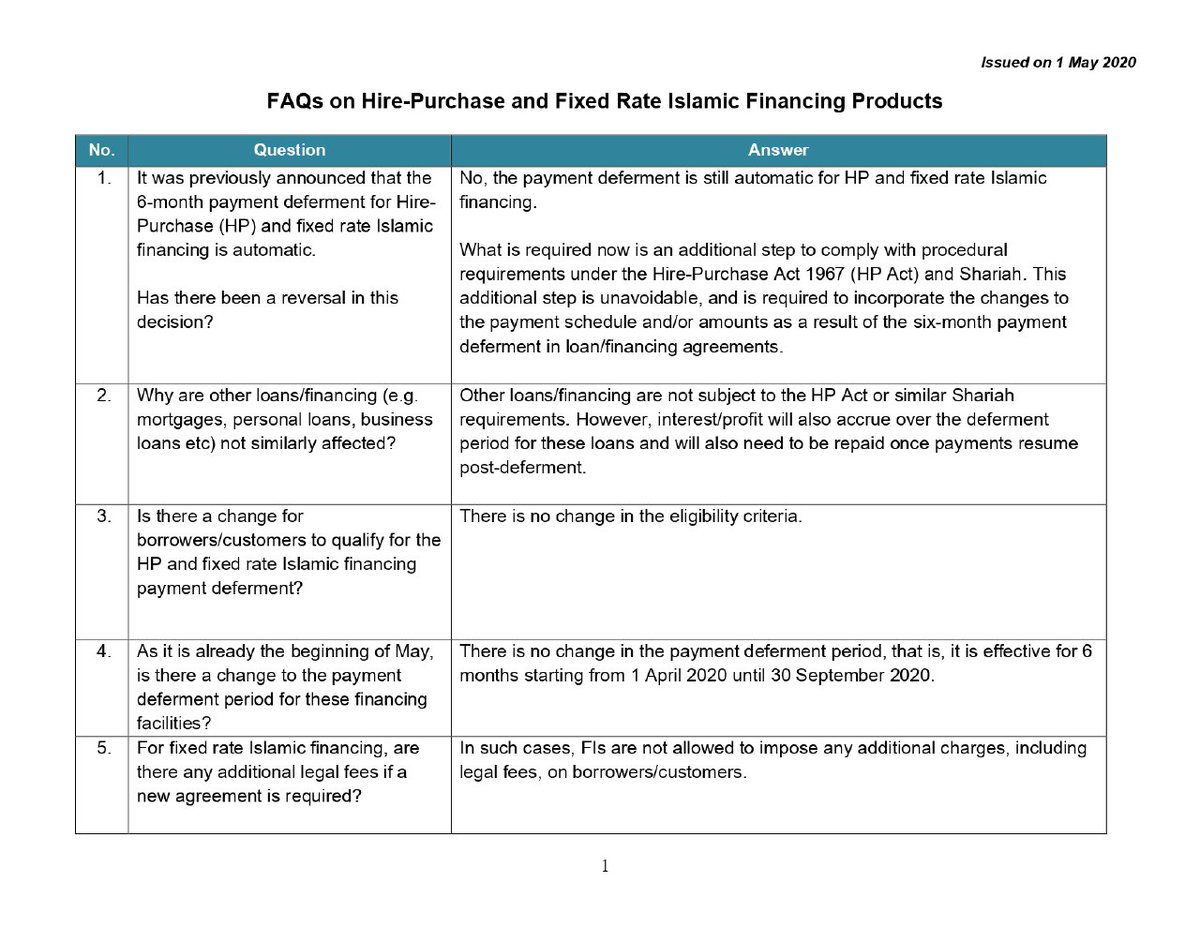

Bank islam hire purchase rate. Further to bank negara malaysia s bnm announcement on 25 march 2020 banking institutions are in the process of formalising agreements which reflect the revised payment terms with borrowers customers with hire purchase hp loans and fixed rate islamic financing to give effect to the 6 month moratorium on loan financing payments. Indicative effective lending rate for bank islam malaysia is 3 25 with effective from 10 july 2020. The bank reserves the right to withdraw and or cancel the auto financing at any time if there is any misrepresentation in any form by you and or if the bank discovers any information which may affect the bank s decision to grant the auto financing and or if the bank has reasons to believe that any information supplied or declaration made by you to the bank in relation to your application for. Bank islam will never request for internet banking account updating via e mail or disclosure of customers personal identification number login id password and i access code to third parties under any circumstance.

This additional step is required to incorporate the changes to the payment schedule. There are many reasons good and bad for leasing. The gross dividend rate for the 12 months investment account. The term hire purchase is derived from the fact that when you take up a car loan the car technically belongs to the lender i e.

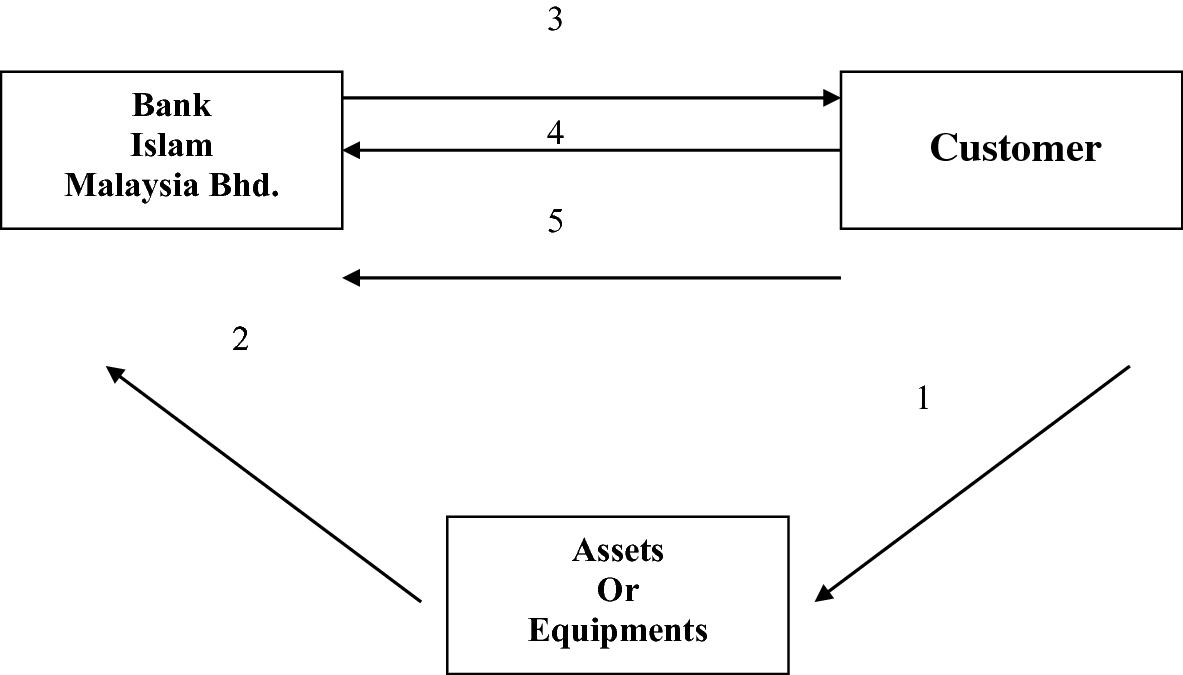

The total leased rental which is fixed throughout the tenure comprises the original cost of equipment and the bank s profit margin. A car loan is also known as a hire purchase loan. The payment deferment is still automatic for hp and fixed rate islamic financing. What is required now is an additional step to comply with procedural requirements under the hire purchase act 1967 hp act and shariah.

Over rm15 000 000 worth of prizes to be won. You are seen as hiring the car from the lender until you complete your loan repayment when the ownership of the car is then transferred to you. It is hereby agreed that the customer shall pay the bank by way of ta widh compensation a sum equivalent to one per centum 1 per annum of the overdue instalment s until date of full payment and or settlement thereof or a sum equivalent to the prevailing islamic interbank money market rate of the bank s r rate i e. Report any suspicious activity at 03 26 900 900.

Aitab i is a banking facility which allows customers to hire and subsequently purchase the assets from the bank at the end of lease tenure.